University Business Travel

Plan → Pre-Trip Approval → Book → Travel → Expense

University business travel includes travel by UCR faculty, staff, students, and hosted guests away from their official headquarters to conduct authorized University of California, Riverside business. Normal commuting between home and work is not reimbursable.

-

Travel Overview

UCR travel follows a consistent lifecycle — from planning and booking through reimbursement — to ensure:

- Compliance with UC policy G-28

- Proper use of University funds

- Timely reimbursement to travelers

-

Headquarters & Travel Status

Travel Status

Employees are on travel status when away from their official headquarters on authorized UCR business. Travel status does not include normal commuting to and from work. Travel status begins when an employee leaves their official headquarters, residence, or another authorized location and travels directly to an approved business destination. Travel status ends upon returning directly to their official headquarters, residence, or another authorized location after completing UCR business. Official headquarters is generally the primary location where the employee performs most of their duties, typically within the city limits of their assigned work location.

Commuting (Non-Reimbursable)

Commuting is the round-trip distance between an employee’s residence and official headquarters. Commuting mileage is not reimbursable.

Travel Mileage (Reimbursable)

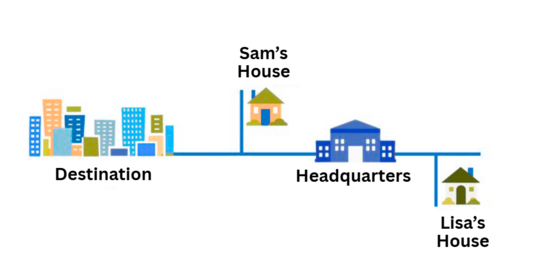

Travel mileage begins at an employee’s residence or headquarters, depending on which is closer to the destination. For example, Lisa and Sam traveled to the same destination. Lisa’s travel mileage began and ended at headquarters because she would have traveled to and from work that day even if she were not on travel status. Sam’s travel mileage began and ended at her residence because her home is closer to the destination than headquarters.

This ensures reimbursement reflects only additional travel required for university business. -

Steps in the Travel Process

Step 1: Determine the Need to Travel

- Identify the business need

- Determine destination and dates

- Consider estimated costs

This step is done by the traveler.

Step 2: Obtain Pre-Trip Approval

- Verify supervisory support

- Confirm funding availability

- Estimate costs and submit a Travel Request in Concur

- For guest (non-employee) travelers and students, a Concur Delegate must submit the Pre-Trip Request on the traveler’s behalf. Before the request can be submitted, the Concur Delegate must associate the guest traveler with the appropriate departmental accountability structure using the University’s Guest Traveler Routing system. This ensures the Pre-Trip Request routes through the correct approval workflow. See the Guest Traveler Routing guide for more information.

- University business travel requires an approved Pre-Trip Request in Concur. The Pre-Trip Request supports duty of care, enables direct billing when applicable, and is required before booking airfare and before an Expense Report can be created. See Pre-Trip Travel Request Requirements for details on when a request is required, who must submit it, required approvals, and timing expectations.

This step is completed by the traveler or by a departmental delegate who obtains the appropriate authorization for the trip.

Step 3: Book the Trip

- Airfare may be booked only after the Pre-Trip Request has been approved.

- Book airfare, lodging, and rental cars in Concur Travel (or through Anthony Travel for complex or international travel arrangements).

- Coordinate itinerary and logistics

- Complete pre-trip requirements:

- UC Travel Insurance enrollment

- Personal credit card or T&E Card

- Cash or foreign currency plan (if applicable)

- Valid photo ID, passport, and visa (if applicable)

- Ground transportation planning

- Destination contact information

This step is completed by the traveler or departmental delegate.

Step 4: Conduct the Travel

- Depart for travel

- Conduct authorized UCR business away from headquarters

- Return from travel

This step is completed by the traveler.

Step 5: Gather Documentation

- Identify reimbursable expenses that were paid for out-of-pocket

- Collect itemized receipts

- Note the business purpose and any unusual or special circumstances

This step is completed by the traveler.

Step 6: Report Expenses

- An approved Pre-Trip Request is required before an Expense Report can be created in Concur.

- Create and submit an Expense Report in Concur Expense

- If actively employed by UC Riverside, travelers should ensure their address and Direct Deposit information are up to date in UCPath before submitting an Expense Report in Concur to avoid delays in reimbursement.

- Account for all expenses:

- Transportation

- Lodging

- Meals

- Miscellaneous expenses

- Provide a clear business purpose

- Explain any extraordinary or unusual expenses

This step is completed by the traveler or departmental delegate.

Step 7: Certify Expenses

- Electronically certify in Concur that expenses are accurate and compliant

This step is completed by the traveler.

Step 8: Review & Approve Expenses

- Review expense reports in Concur

- Evaluate for policy compliance

- Confirm appropriate funding source

- Follow up on questionable expenses

This step is completed by the financial approver or approver delegate, except for exceptional approvals.

Step 9: Process Reimbursement

- Final audit and review

- Process reimbursement for payment

This step is completed by Accounts Payable.

Learn more about Concur Travel and Expense Roles here.

Travel Policy Essentials

This topics below outline a summary of key requirements under UC and UCR travel policy and is not a substitute for the full policies.

-

Responsible Use of University Funds

UCR travelers are expected to spend University funds responsibly, ethically, and in direct support of an approved business purpose. Travel expenses must be ordinary, necessary, and reasonable for conducting University business. Spending that is excessive, personal in nature, or unrelated to the business purpose will not be reimbursed.

Expenses considered taxable income by the IRS are generally not reimbursable, with limited exceptions. Travel expenses are reviewed and approved in accordance with UC and UCR policies, including UC Policy G-28.

-

Business Purpose

All travel expenses must clearly explain how the University benefited. A business purpose should describe who traveled, where and when the activity occurred, and why the travel was necessary. While confidential details should not be included, enough context must be provided to support reimbursement. Travelers are encouraged to retain agendas or supporting documentation in case they are needed for audit or funding source review.

-

Combining Business and Personal Travel

Travelers are expected to clearly distinguish business travel from personal travel and to claim expenses honestly. Personal time added before or after a business trip is allowable when travel is limited to the same destination. However, when additional personal destinations are added to an itinerary, airfare may not be Direct Billed and reimbursement is limited to the documented cost of business-only travel.

Expenses related to side trips, extended stays, or primarily personal travel are not reimbursable. For international travel, UC rules determine whether a trip is considered primarily business or personal. When family members travel with the employee, reimbursement is limited to the cost the traveler would have incurred if traveling alone. Parking and other travel-related costs are reimbursable only for business days.

-

Paying for Others

Travelers are generally expected to pay for their own expenses and submit individual reimbursement requests. Paying for others is limited to specific circumstances, such as supervised group travel or shared lodging with a co-traveler. When paying for another individual is unavoidable, a brief written explanation must be included with the expense report.

-

Airfare

Only business-related airfare may be charged to the University and requires an approved Pre-Trip Request (Concur Trip ID) before booking. Airfare should generally be booked through Concur or Anthony Travel, using direct charge or the traveler’s Travel & Entertainment (T&E) Card as the preferred payment methods. In limited circumstances, departmental staff may use a Procurement Card (PCard) to purchase airfare on behalf of a business traveler or guest; cardholders may not use their own PCard for their travel, and separation-of-duties requirements apply. When airfare is purchased using a PCard, automatic traveler insurance registration does not apply.

Economy or coach class airfare, including economy-plus or similar fare types, is allowable. Business or first-class airfare is generally not permitted and requires exceptional approval with appropriate justification and documentation when allowed under UC policy. Airline-imposed ancillary fees, such as baggage charges, seat selection, or in-flight Wi-Fi, may be reimbursed when they are business-related and reasonable.

Travelers are responsible for reviewing fare rules and cancellation terms before purchase. All prepaid airfare and related airline fees must be recorded in the Travel Expense Report, even when no reimbursement is due.

Airfare and airline fees associated with employee relocation are subject to separate eligibility requirements, limitations, and approval processes. Allowable relocation airfare and related fees may vary based on the employee’s appointment type, funding source, and applicable relocation or personnel policies and are governed by UC relocation policy rather than standard travel rules.

-

Federal Funding (Fly America Act)

When travel is paid for, in whole or in part, with federal funds, airfare must comply with the Fly America Act. This federal regulation generally requires the use of U.S. flag air carriers for travel charged to federal grants and contracts, including federal flow-through funding. Responsibility for compliance rests with the department and Principal Investigator.

Travel supported by federal funds may use a foreign carrier only when the flight is operated under a qualifying code-share agreement with a U.S. carrier. In these cases, the ticket or electronic documentation must display the U.S. carrier’s designator code and flight number. Additional cost or convenience alone is not sufficient justification for using a foreign carrier, and the same requirements apply to travel by foreign visitors when federal funds are used.

Certain exceptions to the Fly America Act may apply, including when no U.S. carrier provides service to the destination, when use of a U.S. carrier would significantly extend travel time, or when specific Open Skies agreements permit the use of a foreign carrier. When an exception is used, appropriate documentation and justification must be provided with the travel request and expense documentation.

- Foreign Travel Back-up Needed for Awards with Federal Funding

- Fly America Act Exception Form

- C&G Awards_Direct Fed and FFT

Refer to this list, published monthly (approx. 15th of month), to determine if an award involves federal flow-through funding and is subject to UCR’s internal review process "Foreign Travel Back-up Needed for Awards with Federal Funding."

For foreign travel charged to federally funded projects, UC Riverside Accounting and Extramural Funds (EMF) review is required prior to reimbursement. If travel does not meet Fly America Act requirements, reimbursement must be charged to a non-federal funding source. Travelers and departments are encouraged to use the University’s preferred travel management company, which can help identify compliant flight options at the time of booking.

-

Transportation and Mileage

Rental vehicles should be booked through Concur (preferred) or ConnexxUC to take advantage of UC-negotiated rates and included insurance coverage. Booking through Concur is preferred because it ensures access to contracted vendors, automatic insurance coverage, and integration with Concur. Intermediate-size vehicles are the standard; larger vehicles may be rented only when supported by a documented business need. Itemized rental receipts are required.

Use of a personal vehicle is reimbursed at the standard UC mileage rate and is based on the most direct route. When a traveler chooses to drive instead of fly, reimbursement is limited to the lesser of the mileage cost or the equivalent airfare and generally requires pre-approval. UC-contracted rental vendors should be used whenever possible to ensure appropriate insurance coverage and compliance with University policy.

Mileage reimbursement for the use of a personal vehicle is based on the current rate established under UC Policy G-28, which aligns with applicable IRS guidance. The applicable mileage rate is automatically applied in Concur at the time expenses are submitted.

-

Lodging

Overnight lodging is generally reimbursable when travel requires the traveler to be at least 40 miles from their headquarters or residence, whichever is closer, unless a documented business need requires otherwise. Lodging receipts must be itemized to be reimbursed, and travelers must use the Itemization tool in Concur to separately identify room charges, taxes, parking, meals, and other incidental costs included on the lodging receipt.

Reimbursement for domestic lodging is subject to the applicable maximum rate established under UC travel policy, excluding taxes and mandatory fees. Conference lodging and lodging in high-cost locations may exceed the standard maximum when supported by appropriate documentation, such as conference materials or price comparisons. International and offshore U.S. lodging is reimbursed based on applicable per diem limits rather than domestic lodging caps.

Advance lodging deposits are reimbursable when required to secure overnight accommodations for authorized University travel. Lodging expenses paid by a pre-approved group leader on behalf of participants traveling on official University business may also be reimbursed in accordance with UC group travel requirements.

When a traveler stays with a friend or relative in lieu of commercial lodging, a non-cash gift may be reimbursed in place of lodging, subject to UC travel policy limits and documentation requirements. Gifts that fall under gift or honoraria policies are not allowable in lieu of lodging.

UC Riverside has negotiated agreements with select local hotels for approved University use when the University is paying for the room. Lodging taxes and mandatory hotel fees associated with allowable lodging or approved events are reimbursable and must be itemized separately in Concur.

Lodging expenses associated with employee relocation are subject to separate eligibility requirements, limitations, and approval processes and are governed by applicable relocation policies rather than standard travel lodging rules.

-

Meals and Incidentals

Meals and incidental expenses are generally reimbursable only when travel exceeds 24 hours or includes an overnight stay that is at least 40 miles from the traveler’s headquarters or residence, whichever is closer. For travel within the continental United States, reimbursement is based on actual out-of-pocket expenses up to the applicable daily maximum established under UC travel policy; this maximum is not a per diem. International and offshore U.S. meal and incidental limits vary by location. Incidentals include customary tips. Receipts are required for individual expenses of $75 or more, unless restricted by the funding source.

Meals paid by a team leader on behalf of individuals participating in pre-approved group travel are allowable when consistent with UC policy. Departments are responsible for ensuring that applicable per-person meal and incidental limits are not exceeded. Any portion of a meal and incidental expense that exceeds a traveler’s actual out-of-pocket cost must be reduced in Concur to comply with UC reimbursement limits.

Meals and incidentals incurred during relocation travel may be allowable but are subject to additional restrictions based on the employee’s appointment type, funding source, and applicable policy. When driving instead of flying during relocation travel, mileage, meals, and other related expenses may not exceed the cost of equivalent airfare and ground transportation, and daily driving distance requirements must be met.

Business meals and meals associated with social or entertainment activities while on travel status must follow the same rules that apply to non-travel business meals and entertainment expenses, including funding restrictions. Certain meal or entertainment expenses may not be allowable on federal or other restricted funds.

-

Cancellations and Changes

Travelers are responsible for canceling reservations in accordance with vendor policies. Refundable tickets and deposits must be returned to the University. Charges resulting from failure to cancel are not reimbursable unless due to circumstances beyond the traveler’s control. Change fees may be reimbursed when supported by a documented business reason.

-

Dependent Care While Traveling

Under limited circumstances, expenses related to dependent travel or extraordinary dependent care may be reimbursed when pre-approved in advance. All dependent care reimbursements are taxable, must be paid by the traveler, and are funded by the department. Reimbursement is denied if required pre-approval is not obtained.

-

Reporting Travel Expenses (Including T&E Card Charges)

A Concur Expense Report must be submitted after each trip, even when no reimbursement is due. Reports should be submitted within 30 days of trip completion. Extended or recurring travel may be reported monthly or quarterly. Late submissions may result in taxable income.

This requirement includes reconciling all charges made on a University-issued Travel & Entertainment (T&E) Card, which must be substantiated within the same reporting timelines.

If a Separated Employee Is Impacting Reconciliation

If you find card charges related to a separated employee or legacy supplier:

- Submit a ticket in the Finance Administrative Services Portal.

- Select “Request Help,” then choose Travel & Expense as the Service/Business Area.

- In the Short Description, include language such as “Card charges for separated employee” or “Card charges for legacy supplier number.”

- Identify key roles in the ticket:

- Delegate who will prepare the expense report in Concur.

- Pre-approver (optional).

- Financial approver who will be responsible for final approval.

- Attach supporting documentation:

- Screenshot(s) of the related aging charges from the Card Aging Report.

- Any other relevant documentation.

For detailed guidance related to employee reimbursements and separated employees, refer to the Concur Employee Reimbursement Guide.

Using the Concur Card Aging Report

If appropriate, your Department SAA can assign you access to the Concur Card Aging Report in iReport, which is the primary tool for identifying unprocessed and aged card charges (PCard, T&E and “Ghost” cards) that remain outstanding from prior cycles. Use this report to:

- Identify all uncleared T&E and card charges, including those dating back to prior years.

- Review both unassigned and assigned card charges. Any charge not on an approved expense report is not yet reflected on the department ledgers.

- Prioritize older charges first, focusing on those in the oldest aging “buckets.”

- Follow up with cardholders and delegates to ensure charges are added to expense reports, coded correctly, and submitted for approval.

- Monitor progress and keep local documentation for audit readiness.

- Submit a ticket in the Finance Administrative Services Portal.

-

Receipts and Records

Itemized receipts are required for airfare, lodging, car rentals, conference registration, and any expense of $75 or more. When a receipt cannot be obtained, a written explanation must be provided*. Inadequate documentation may result in denied or taxable reimbursement. Travelers are encouraged to retain records supporting business travel expenses.

Note: In Concur, the system feature that serves this purpose is referred to as a “Missing Receipt Declaration.” This allows a traveler to attach a declaration to the specific expense line when a required receipt is lost or unavailable.

-

Entertainment While Traveling

Entertainment expenses incurred while on travel status must comply with UC Entertainment Policy BFB-BUS-79 and require a documented business purpose and attendee information. Spousal attendance requires exceptional approval.

-

Extended Travel

Trips longer than 30 days involve additional considerations and reimbursement rules. Travelers should consult policy guidance before beginning extended travel.